I am sure that you have probably faced this situation once or twice, if not more, in your life.

You are all enthusiastic, fired up with energy, you have this grand idea that is going to change the world or make you billions, and bang, when you share it with the one person whom you thought would love it and invest in it, they will tell you that this won’t work.

Why is it that they can’t see the potential in your idea? Why is it that they think it will not be profitable?

The answer is not as simple. Sometimes they are right and many times they are wrong. Their answer is based on their experience and they could have all the experience in the world, and be the wisest and savviest businessmen but still, they could be wrong. In fact, take one look at the creme de la creme of the investors, and startup VCs, according to generalized statistics 9 out of 10 of their bets don’t make it the way they had anticipated.

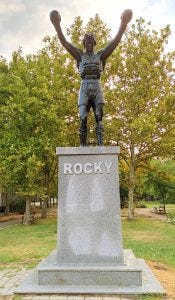

The above is not true just for startup investments but in almost many other cases. The numbers are probably different but it is industry agnostic, JK Rowling was turned away for her book “Harry Potter” many times, the rock band “Queen” were told that their six-minute long song “Bohemian Rhapsody” would not work, Silvester Stalone went around selling the idea of “Rocky” as a movie until he was down to his last pennies and had to sell his dog to survive. Yet all of them did not just do well, but they went beyond the expectation of just doing well. They broke all records, expectations, and much more.

So why is it that such experienced, business-savvy, wise, and clever people get it so wrong? I emphasize the so wrong because many of these were not just people or numbers that did OK, but in many cases, they were a worldwide hit.

If I answered the above question then I would be making the same mistake of proving myself right over their wrong and then I would be just as wrong, however, I have some explanations as to why such brilliant minds get turned away over and over again.

In many cases, our analysis is based on past historical data. Queen’s song Bohemian Rhapsody was simply double the length of all other songs in those days and most probably research etc had shown that attention span etc was on average 3 to 4 minutes. Most probably other artists that had attempted with longer songs had failed and hence the final conclusion that this might not work. (This is an extremely simplified view, based practically on what I saw from the movie and the bits and pieces I have read in various articles). However, the point I am trying to make is the analysis was based on historical data and the experience(s) of the decision-makers.

The same was true in my case, for my startup. When I started, pitching my Startup idea Urbytus to investors, I wanted to make it a free tool on the web, free for all, just like Facebook and Google. For years I battled and from one Business Angel to another VC they either could not see the advertising model revenue or felt it was too far-fetched and or not for their pocket and the investment time frame. Finally, I had to change this to a Software as a Service model which of course created a barrier to entry but the upside is that it generated some revenue. The problem once I started generating revenue was that unlike the traditional prices for software and bespoke programs, where you can sometimes charge substantial sums, I was aiming to sell it at affordable prices that were difficult to get a return on investment in the first few years but did generate enough money over the extended years of its life. In particular, I remember my extensive chats with one of the Business Angels that I was very close to. In his experience, we should have been selling the software at 10 to 12K per annum, while my idea was service fees of around €50 to €100 / month.

Who was right or wrong? His analysis was based on his experience when he had to purchase software for his company and mine was based on what I could see on the internet and the upcoming trend and available services at low monthly prices with practically no setup fee or in many cases, free for life for limited version or use.

What has all the above got to do with passion?

In my personal view and from everything I have read, including the many articles in the Financial Times weekend from interviews and reviews on the people who have made it, is that without exception the ones who made it were passionate about their work, and ideas and pushed against all odds. They didn’t stop at the NO and the REJECTIONs of the savvy businessmen and investors. They believed in themselves, and in their idea and it was their passion that provided them the energy to move forward toward their goal.

Yet passion as Rai Siddhant Sinha describes in one of his research can be addictive with negative side effects. Rai explains how entrepreneurial passion can shift to entrepreneurial addiction through the pleasure-pain pathway governed by dopamine, in a relentless pursuit of pleasure, an individual chases entrepreneurship because they are passionate about it but end up addicted to it (full paper here: https://lnkd.in/ew5CFF-G).

However if I have to sum up in short what have been the two factors in common for all the successful people whose stories I have read and witnessed, it comes down to their relentless passion and vision. In entrepreneurship of any kind and not just startups, you need to have a sharp focus on your goal (The Vision) and you need mental energy to help you push against the obstacles (The Passion). In many of the most amazing examples from Edison to Elon Musk they all encountered many obstacles beyond your wildest imagination, and apart from the many other factors their Passion and Vision are two common things that helped them push through.

While the excess of anything can be addictive and the pursuit of entrepreneurship in the relentless goal towards success can also be considered a hormonal addiction, history has shown over time that those who relentlessly followed their passion have been the ones who succeed against all odds.