Over the past 5 years, I have had the pleasure of working with many startups in numerous incubators and accelerators. On average I have received and reviewed 5 to 10 pitchdecks per week and I have worked, hands-on, approximately with one or two startups per month to improve their pitchdeck and get them ready for fundraising.

What I have identified during this time are 5 issues that I can say are almost always the same in all startup pitchdecks that are made for fundraising.

This is my personal experience and a generalization but I am sure if you get an outsider to review your pitchdeck and then cross-check with the list below, they might agree to a certain extent or more.

- All about the product

As entrepreneurs, we are passionate about the solution we have found to the problem we are solving. We have done a lot of research into the market, spoken to clients, and received feedback from industry experts and as such we have come up with “The Golden Product / Solution”.

Our pitchdecks almost always start with the problem -> solution, which is great because we can’t start otherwise. However the problem is that we continue to explain, in more and more detail the product and all its functionalities. Before we know it some decks are just 10 to 20 pages just explaining the product.

I also used to think that if I explained the product well the investors would better understand the opportunity.

If you are fundraising. The investors you are talking to and those reviewing your pitchdeck are interested in an idea where they can double, triple or 10X their money. Money sitting in the bank even with the current higher interest rate is not interesting. Anyone investing knows that you can generate a better return when your money is working.

Investors are listening to you and your idea, in order to find a better Return On Investment than they currently have.

Your pitchdeck should concentrate on the investment numbers. Allowing the investor to quickly understand the problem / solution and before you have even finished explaining their mind has already gone into questions like

- What is the profit margin per product?

- What is the market size (number of potential clients)?

- What is the sales cycle and frequency?

- What are the distribution channels?

- How much can YOU sell locally, & How much can they help you sell to their bigger network, and if they think there is a bigger need beyond your close circle of friends and contacts?

- How much do they need to invest?

- Where will the money be used for?

- What are you bringing to the table?

- Will the return be above the current interest rate (in banks or bonds)?

- What are the risks of, you failing? or the product not selling?

- When are they going to get their money back?

Do you want me to continue with the zillions of questions that go through the minds of most business angels? These are all about numbers. About traction, safety, growth potential, certainty versus risk, and clients.

Your pitchdeck should provide all the basic numbers for the algebraic formulas that any one of us needs to calculate the above, such as: The unit cost of a product, The average profit margin, The Operation cost and how it can be reduced, and if they can reduce it using their expertise/connections.

Numbers, numbers, numbers. Above all: the basic numbers, which brings us to the next point.

2. Market Potential (Millions & Billions)

In Incubators and Accelerators and pretty much all the material you read on the internet they ask you to work out the TAM / SAM / SOM.

Pitch decks are riddled with huge numbers in market potential in the hundreds of millions if not billions. Yes including my pitchdeck. I presented to the TAM from a very reliable source €40B (40,000,000,000).

This number represented the total money that was spent by all potential customers in all the verticals. Let me be more specific. My market was the Home Association. In Spain, Home Owners Associations (HOA)spend about €40B on things like management fees, gardening, painting, swimming pool maintenance, insurance policies, cleaning, general maintenance, lifts, doors, and … etc. However, I was tackling the management software industry in this market which was about €13M.

However, even this number is vague, because it does not tell you anything about the number of clients.

But what if I told you that there are approximately 19,000 HOA management companies in Spain and that the average fee for a license is €57/month (equivalent to €684 or approximately €700/year). The total market is €13M/year.

Do you feel better informed? Do you not think that you have some basic numbers at hand with which you can now do your own risk/potential calculation?

What if I expanded on this number?

Each Management company manages approximately 50 HOAs. In Spain, there are a total of 776,500 HOAs. Our product is aimed at this market at an average price of €50/month. If we sold to all the potential market then it would generate €465M/year. This is our TAM in Spain. Our initial expectation in the first few years is only 7000 HOAs, generating an approximate €4M/year in subscription fees.

Ellas, I took too long to reframe my number but last week, I helped another startup represent their numbers, in $$ and Potential Client. Here is how it looks now.

Can you see how easy it is to see the relationship between total number of clients and revenue generated? Is it not more meaningful to you than if we have just presented the market in $$$?

I don’t know about you, but it makes me shiver seeing those multi-million $$$ without seeing the underlying numbers explaining how you calculate them or what they refer to.

3. Competition Analysis

I have written on this subject before, (click here to read the full article)

Startups are the innovators, disrupters, and we are the best. We have the solution which the competitors have failed to provide and cannot see the potential for.

Well, that’s what we think. Don’t get me wrong. Yes, we have come up with a solution to a problem, and the competitors obviously have not started tackling the issue as yet but before we do anything else, I ask you to check your Competition analysis page. If you have a comparison chart you as the startup have everything ticked. You offer everything that the client needs in your package (even though many of those modules or services have not been developed yet, the intention is there, so the tick is there). This is while your competitor who is making millions has only one box ticked as a service.

Let me analyse this from my perspective as a viewer. The competitor has a Unique Selling Point and advantage and service which is UNIQUE. This makes their sales proposition very easy, and convincing and they address the need of their clients. In the process, they are generating millions and they FOCUS on what they do best, and of course, it is doing so well that they have not really focused too much on your solution because they are already generating millions.

We as the startup, want to provide this new solution and at the same time take away the market they have already obtained by offering Service 1 and Service 2,3,4 to the client. Of course, it is a no-brainer. Any client should jump at the opportunity. Unfortunately, that’s not the case. Clients are more resistant to change than you think and unless there is a high-value USP, it is unlikely that you can get them to change.

Unfortunately, aggregating services is not always a USP because it requires a huge time and effort, more HR and Financial resources, and downtime than we care to take into consideration.

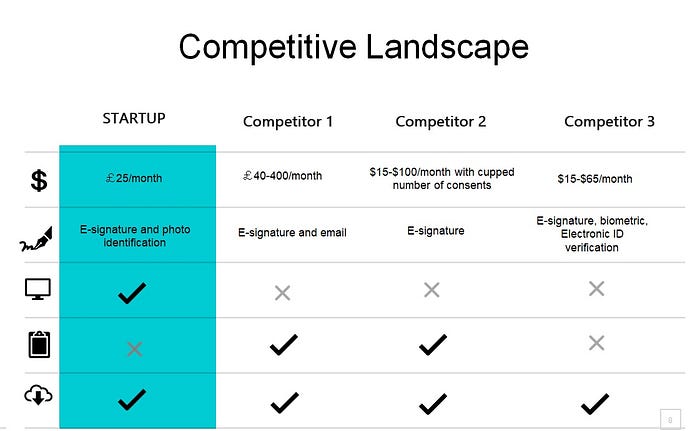

Here is an example of an improved Competition Analysis page.

In this competition analysis page in the first two rows, we compare the various price structure in the market. We are talking about competition analysis. It is important for anyone to know where you stand in the market when it comes to your price tag. This is a simple way of presenting it and helping anyone see the market. In one glance, I can see that in this example the price tag is reasonable and somewhere in the middle.

Next is the type of one of the services offered. Again it is not about highlighting who has the best system and showing superiority, it is about creating and understanding of the different ways and services available.

Only in the final three rows, do we look at the USP. We look at one service that differentiates the startup from its competitors. We showcase the service that is making the competitors millions of euros, and finally, the one service that is required and common to all.

My suggestion. Concentrate on making your competitors shine, explain differences in simple ways, and show your USP by ticking ONE box.

4. Traction- Vanity Metrics

I will keep this one short as it is an obvious one.

In particularly common in early-stage startups because we don’t really have that many metrics to present. As a result, pitchdecks are riddled with meaningless metrics, such as the number of followers, users, logins, likes, shares, etc, etc.

They are all known as vanity metrics. Metrics that cannot be used to derive any meaningful conclusion.

What is more important is numbers like:

- Sales Cycle for close contacts VS cold sales

- Sales frequency

- Upselling opportunity

- Measured Advertising Metrics & controlled sales experiments

Numbers that can be used for basic block analysis are much better and more effective for attracting investors. Small numbers are the building blocks of all calculations. They help investors work out risk vs profit and potential.

On the other hand, vanity metrics provide no value. You think you are getting them to see the big picture and potential and creating FOMO, but in reality, you are adding confusion and ambiguity to your presentation.

5. Funding Ask

The big ask. We have all heard about startups raising tens and hundreds of millions. We are encouraged to create a 3 to 5 year financial plan. They tell you to think big and you read about founders the like of Adam Neumann (CEO of WeWork), flying around in his private jet, having parties in a guitar-shaped villa (or whatever it was I can’t remember and is not worth my time checking this fact).

My point is all the above unfortunately pushes us to create an unfeasable financial pitch. The last startup I worked with, was raising €1.7M. After extensive analysis, we boiled it down to €315,000.

The FP was riddled with high salaries, unrequired services, and costs that were totally out of proportion. Partly due to reason because of no previous experience and other parts due to the fact of having been misguided by others.

What you ask determines whether you actually get funded or not. The numbers have to match up with what you present, the market, the potential, the client conversion rate, and the time allotted / required for each client; lead to successful integration and long-term paying users.

If you are an early-stage startup with little to no metrics or paying customers, you may find it easier to focus on an 18-month plan. Lower your expectations (not your vision). Focus on immediate sales and growth. Work on what it really costs to do with as little as possible. Do some sales testing. Calculate your CAC and describe in numbers that can be backed. Measure the time it takes from getting a lead to converting a client, and measure your client’s satisfaction with the process and service.

If you are approaching Business Angels for early rounds, remember that each business angel has different criteria. Not all have the same amount of cash. Their age will tell you something about how long they will be willing to wait for a Return On their Investment. A 75-year-old business angel (BA) may have a much shorter ROI time than a 40-year-old BA. A 40-year-old BA may have less cash but more expertise and contacts in the sector.

Each BA will look at your FP from their perspective. Some will be willing to pay you a nominal salary and some will be reticent but few will be willing to pay you a high comfortable salary. Most if not all will probably expect you to continue to put your blood and sweat into the project with as low a salary as possible until costs are covered, until the business can pay basic wages, and of course, they want their ROI, so your salary should in way getting in the way, or else they might just leave that hard earned money in the stock market or the bank.